How Rethinking File-Sharing Can Help Tax Preparers in 2025

Self-serve online tax services are gaining in popularity. While some people enjoy the convenience of e-filing from home, for others these online services lack something very important: the human element. Tax preparers can use their expertise to help their clients navigate their tax filing process with simplicity and ease.

This personal, hands-on approach is a tax professional’s greatest asset, but it can also be their biggest downfall when slow or complicated processes eliminate the “convenience” factor from their client’s experience.

Tax preparers are fighting against three main complaints: the length of time it takes to file the return, the security of the interaction, and the complexity of the experience.

On self-service e-filing programs, individuals can simply upload their tax information, follow guided steps, and file in the same night. That’s where tax preparers reach their snag. Gathering information and handling it in a secure way can throw a wrench in the workflow and the customer’s experience.

As a tax preparer, taking an earnest look at the way you collect your customers’ data can actually have a bigger impact on your workflow, workload, and overall client experience than you may realize.

Reevaluate The Way You Gather Your Customers’ Sensitive Data

Tax preparation firms are obliged to follow a host of regulations when it comes to securing data; among those are IRS Publication 4557, NISTIR 7621, and the FTC Safeguards Rule. All three require the use of encryption to protect sensitive client data or business data, at rest and in transit. Tax preparers must be vigilant about access controls to data, and only allow access to necessary individuals. They also must destroy information not necessary to the business after a certain period of time.

These complex regulations have brought about complex file-sharing solutions. Communicating and collecting data from customers plays a bigger role in the tax prep workflow than you might think: Requiring clients to come into the office to share sensitive tax information, or forcing them to set up accounts in secure, but convoluted file-sharing portals, may be a more secure way of accessing customer information, but it’s overcomplicating everything.

You no longer have the time or bandwidth to jump through these hoops: CPAs, accountants, and tax prep firms are consistently overworked and burning out. With talent shortages, you might be taking on more clients per head. In order to remain competitive, you’ll need the right solution that blends security, speed, and ease.

For the average consumer uploading tax information to a site, security is built into the fabric. What tax preparers don’t realize is that they can build security into the fabric of their file gathering process while making it just as convenient for their client.

Secure Share is for Tax Preparers: Receive Sensitive Data Securely, Quickly, and Easily

With Secure Share from Virtru, tax professionals can give their clients the convenience of sharing their tax documents virtually without compromising security, while still continuing to provide the hands-on, personalized approach that sets them apart from online services.

Easy to Use

Taxpayers come to you when W2s, 1099s, and 1040s get too complicated. Secure Share makes their experience easier every step of the way and allows you to receive and share sensitive documents faster. Secure Share has a clean and intuitive interface for users on both ends: tax preparer and client.

Quick to Get Started

Virtru data protection solutions have a proven track record of easy adoption on both the client and business side–meaning you can phase in Secure Share seamlessly as business ramps up. Secure Share runs on any browser–clients won’t need to download a thing, and can share data with you anywhere they go. Most importantly, rapid deployment and user adoption will ensure employees and clients aren’t using insecure data sharing workarounds.

FTC Safeguards and IRS Pub 4557 Compliant Encryption

Fortified with AES 256-bit encryption at rest and in motion, all data protected by Virtru meets a military-grade standard. Leveraging the Trusted Data Format (TDF) as our foundational tech, Virtru’s Secure Share enables end-to-end auditability, as the TDF and supporting infrastructure logs every key request for persistent visibility. This gives the data owner insights on where their data is traveling, who has accessed it, when, and what was done with it—and the ability to update and oversee these access controls at any point in time.

All of these security features wrapped into one secure file-sharing tool helps you check off more boxes in your FTC Safeguards compliance checklist and IRS Pub 4557 requirements.

Granular Access Controls for Internal and External Data Sharing

Secure Share is intended for encrypted file sharing anywhere, and with anyone. Data owners maintain control over their data at all times, with the ability to add more security settings or revoke access to a file at any time. This helps ensure that only the intended recipients have access to the file and gives customers the peace of mind to freely share sensitive information, knowing they have control over it even after it’s been sent. Think of it as putting your data on a leash.

How It Works: Requesting Tax Documents From A Client

It only takes a couple of clicks to request tax documents from your clients, and only a couple of clicks for them to send it to you. Here’s Secure Share broken down into four steps—though in real time, it takes less than a minute to request data.

1. Generate A Unique Link

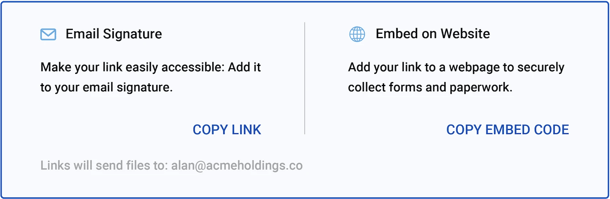

To request and receive files from a collaborator, Secure Share users start by copying their personal link. Each Secure Share user is assigned a link completely unique to them to ensure that the right files are shared with the right person at all times.

2. Send to Your Client and Request Files: No Portals, Account Setup, or Network Needed

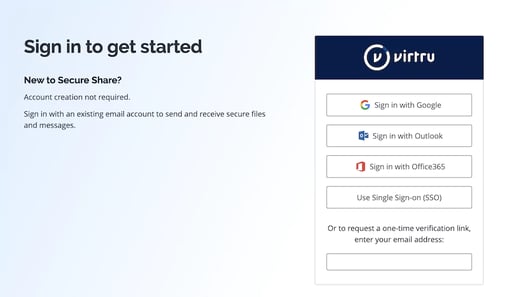

Send your link any way you prefer, like email, chat or text. Through this link, your client can authenticate their identity, then begin uploading their files.

3. A Few Clicks and Files are Uploaded and Shared

Next, the client can share their information in less than half the time it would take to log into a traditional secure file-sharing portal. Their private tax information will be encrypted upon upload and during transit. Once uploaded, the client can set specific security controls for their data like an expiration date, watermark, and more.

/finserv%20resource%20roundup%20page/24-SecureShare_Upload.png?width=497&height=384&name=24-SecureShare_Upload.png)

4. You Access The File in Record Time

Next, you receive access to the file through your email or through a notification in Secure Share. It’s that easy.

There’s More That Virtru Can Offer Tax Prep Firms

The IRS, FTC, and NIST have a piling list of regulations required of tax preparers, and it’s not easing up anytime soon. But this doesn’t have to be a burden.

Virtru’s suite of streamlined encryption solutions for Microsoft and Google-run financial services firms and tax preparers can be powerful tools in your journey to compliance. You can achieve a healthy data security posture without sacrificing your industry-standard tools, workflow, or customer experience.

Over 7,000 businesses use Virtru to encrypt their emails, drives, and SaaS applications– to automatically encrypt sensitive information of their choosing.

To learn more about how tax preparers can benefit from Secure Share, and what other tools Virtru has to offer, schedule a demo with our team today.

Shelby Imes

Shelby is the Manager of Content Strategy at Virtru with a specialty in SEO, social media, and digital campaigns. She has produced content for major players in healthcare, home services, broadcast media, and now data security.

View more posts by Shelby ImesSee Virtru In Action

Sign Up for the Virtru Newsletter