GLBA Compliance: What Financial Security Leaders Need to Know

If there is one universal truth in the cybersecurity world, it’s that financial data remains the "crown jewel" for threat actors. From sophisticated ransomware gangs to opportunistic hackers, the appetite for sensitive financial information has never been higher, and the methods used to extract it have never been more advanced.

Because the potential blast radius of a financial breach is so massive, organizations handling this data face an understandably high level of scrutiny.

For over two decades, the Gramm-Leach-Bliley Act (GLBA) has been the regulatory bedrock for protecting consumer financial information. However, if your compliance strategy hasn't evolved since 1999, you are likely falling behind. With the recent updates to the FTC Safeguards Rule, the bar has been raised.

This guide covers the basics of GLBA compliance for the modern security leader and explores how a data-centric approach to security can ensure you meet the new, rigorous standards.

Who Is Subject to GLBA Compliance?

The GLBA applies to "financial institutions," but don’t let the terminology fool you. The definition is significantly broader than just banks and credit unions. It encompasses any business significantly engaged in financial activities.

According to the FTC, if your business participates in the following, GLBA likely applies to you:

- Mortgage lending and brokering

- Tax preparation and accounting

- Auto dealerships (leasing and financing)

- Investment advisory services

- Debt collection

- Real estate settlement services

If your organization handles Non-Public Personal Information (NPI) regarding loans, financial advice, or asset management, you must adhere to GLBA standards.

Recommended Reading: Kunes Auto Group Uses Virtru to Encrypt Data For FTC Safeguards

The Updated FTC Safeguards Rule: What Changed?

For cybersecurity professionals, the most critical aspect of GLBA is the Safeguards Rule. While the Privacy Rule dictates how you notify customers about data sharing, the Safeguards Rule dictates how you must protect that data.

The FTC updated the Safeguards Rule to keep pace with modern technology. The days of vague guidelines are over; the new rule is prescriptive. To remain compliant, security leaders must now implement:

- A "Qualified Individual": You must designate a specific person responsible for overseeing and implementing your information security program.

- Written Risk Assessments: You must conduct periodic, documented assessments of internal and external risks to customer information.

- Mandatory Encryption: The rule explicitly mandates encryption for customer information held in transit and at rest.

- Multi-Factor Authentication (MFA): Accessing customer information now requires MFA for anyone accessing your system.

Recommended Reading: Redfin’s Title Forward Uses Virtru Encryption Software for Real Estate Transactions

Moving From "Checklist Compliance" to Data-Centric Security

Meeting the letter of the law is one thing; actually securing your organization is another. The Bureau of Consumer Protection and the FTC emphasize that compliance isn't a "set it and forget it" task.

Modern GLBA compliance requires a shift in mindset. It’s no longer enough to build a firewall around your network and hope for the best. In an era of hybrid work and cloud collaboration, your data doesn't stay behind a firewall. It travels via email, it sits in cloud storage, and it moves between partners.

This is where Zero Trust comes in. To satisfy the rigorous demands of the modern GLBA landscape, you need to verify every user and secure the data itself, not just the perimeter.

In this video, Virtru customer and FinTech leader SpotOn shares about their experience looking for a simple-to-use solution to protect sensitive financial customer data.

How to Meet GLBA Email Encryption Requirements with Virtru

The updated Safeguards Rule places a heavy emphasis on encryption. If your data is encrypted, it is rendered useless to a hacker, even if they manage to steal it.

However, historically, encryption has been a headache for financial services. Legacy email portals are clunky, friction-filled, and frustrate clients. When security is difficult, employees find workarounds, leading to "Shadow IT" and unprotected emails sent in the clear.

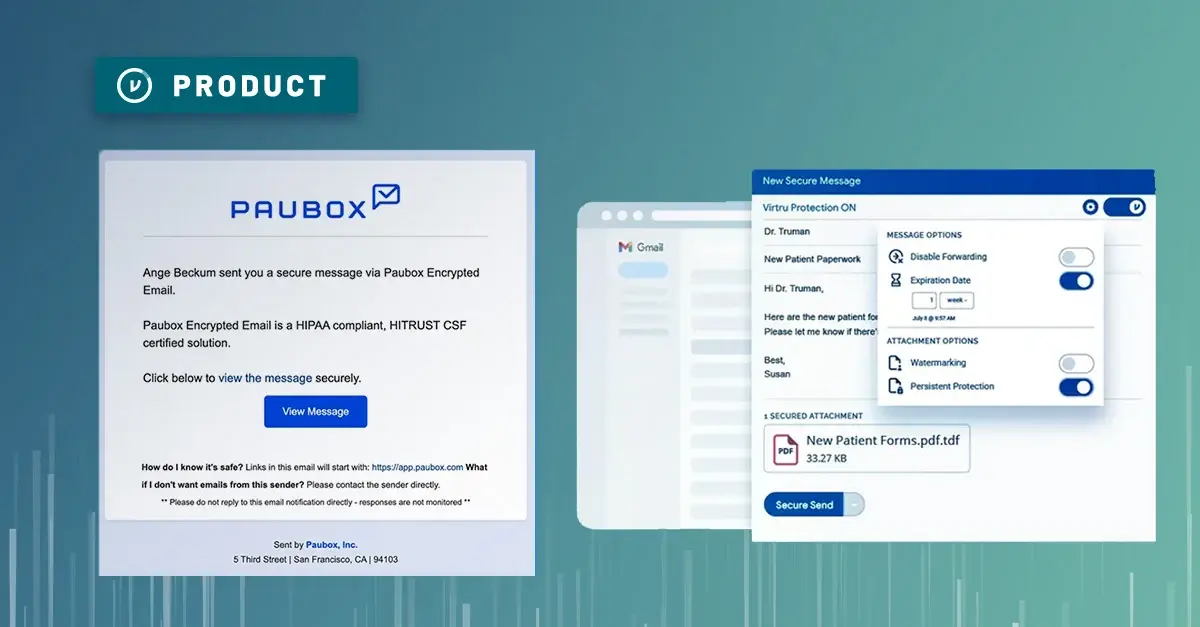

Virtru allows financial organizations to meet the strict encryption requirements of the GLBA without sacrificing workflow or user experience.

- End-to-End Encryption for Email and Files: Virtru integrates directly into the tools your teams use every day (like Gmail, Outlook, OneDrive, SharePoint, and Google Drive). With a single click, NPI is encrypted client-side, ensuring that only the intended recipient can unlock it.

- Secure File Exchange with Customers: Virtru Secure Share is valuable for both sending and receiving NPI securely. You can securely request a customer's proof of identification for a KYC (Know Your Customer) program or other identify verification practices that are part of your workflow — all while maintaining trust with your customer.

- Granular Access Control: GLBA compliance is about controlling who sees data. With Virtru, you can disable forwarding, set expiration dates for sensitive documents, and even watermark files to deter leaking.

- The "Undo" Button: Did an employee accidentally send a loan application to the wrong "John Smith"? It happens. With Virtru, you can instantly revoke access to a sent email or file, mitigating a potential breach immediately.

- Audit Trails for Compliance: Virtru provides detailed logs of who accessed data, when, and where. This makes demonstrating compliance to auditors or the "Qualified Individual" straightforward.

The Consequences of GLBA Non-Compliance

The stakes for ignoring GLBA have arguably never been higher.

- Civil Penalties: Financial institutions can face fines of up to $100,000 for each violation. Officers and directors can be personally fined up to $10,000.

- Reputational Damage: Beyond the fines, the cost of a breach includes legal fees, credit monitoring for victims, and the catastrophic loss of consumer trust. In the financial sector, trust is your currency.

- Enforcement Actions: With the updated Safeguards Rule, the FTC has signaled a willingness to aggressively pursue organizations that fail to implement basic cyber hygiene, like encryption and MFA.

Frequently Asked Questions about GLBA (FAQ)

Does GLBA require email encryption?

Yes. Under the updated FTC Safeguards Rule, financial institutions are required to encrypt customer information both in transit (email) and at rest (storage), or implement an equivalent alternative measure that provides the same level of security.

What is the penalty for a GLBA violation?

Institutions can be fined up to $100,000 per violation. Individuals in charge can be fined $10,000 per violation and face up to 5 years in prison.

Who is the "Qualified Individual" under the Safeguards Rule?

This is a designated employee or third-party service provider responsible for overseeing and implementing your information security program.

Secure Your Data, Secure Your Future

The threat landscape is growing more complex, but the solution doesn't have to be complicated. GLBA compliance ultimately boils down to a simple concept: Respect and protect the data entrusted to you.

By leveraging tools like Virtru, you can encrypt data in transit and at rest, maintain total control over your information, and satisfy the rigorous standards of the FTC Safeguards Rule — all while keeping your business running smoothly. Contact our team today to see a demo of Virtru for GLBA compliant email and file sharing that meets you where you work.

Editorial Team

The editorial team consists of Virtru brand experts, content editors, and vetted field authorities. We ensure quality, accuracy, and integrity through robust editorial oversight, review, and optimization of content from trusted sources, including use of generative AI tools.

View more posts by Editorial TeamSee Virtru In Action

Sign Up for the Virtru Newsletter

/blog%20-%20HIO%20Maya%20HTT/Maya-HTT-Level-2-lessons%20copy.webp)

/blog%20-%20cmmc%20level%203/CMMC-LEVEL-3.webp)

/blog%20-%207%20Healthcare%20Vulnerabilities/7-hipaa-vulns.webp)

/blog%20-%20please%20delete%20that%20email.%20domain%20wide%20protection/please-delete-that-email.webp)

/blog%20-%20next%20breakfast/next-breakfast-2.png)